In 2025, the average business insurance policy in Canada costs between $500 – $5,000 / year.

True or false?

Every small business is exactly the same.

FALSE!

Of course.

As a small business owner, you were probably offended at that very suggestion.

Well, because every small business is so different, there’s no quick answer to this question.

The cost of insurance for a small business can vary greatly depending on its size and scope.

Some industries are at higher risk than others. Some companies have more revenue than others.

And there are tons of other variables.

So before we dive into the details, if you’re looking for a quick quote, here are some of the features of the business insurance companies we work with:

Companies we partner with for business insurance

Now, let’s get into it.

The true answer to the question How much does an insurance policy cost for a small business? is … IT DEPENDS.

Let’s look at an example to explain why.

A roof installation company will have higher small business liability insurance costs than an ice cream store.

Let’s look at it from the perspective of an insurance company:

When looking at the likelihood of causing third-party damage, what can go wrong for a roofer?

A roofer could

- Set the roof & entire building on fire while installing the shingles

- Cause structural damage to the roof during the course of construction

- Conduct faulty workmanship, resulting in severe water leakage

An ice cream parlor could

- Accidentally have a stone in the ice cream and chip someone’s tooth

- Be responsible for a customer slip & fall due to slippery floors

- Serve bad ice cream, resulting in someone getting sick

The average roofer claim can be upwards of $50,000!

While your average small ice cream parlor liability claim is about $5,000.

This short comparison shows that while both businesses can cause damage to other people or things, these accidents vary significantly in dollar amounts.

In other words, the roofer is more likely to cause a significant small business liability claim than the ice cream parlor, and the price for their insurance policy will reflect this reality.

This difference is why the average ice cream parlor pays less for its small business insurance than a roofing company.

Buckle up for today’s blog, because we have A LOT of ground to cover.

TABLE OF CONTENTS:

- How we calculate your business insurance cost

- What does business insurance cover?

- How to lower your business insurance cost

- Can home insurance cover my business/ liability?

INDUSTRIES

- Amazon seller insurance

- Contractor insurance

- Restaurant insurance

- Textile distributor insurance

- Advertising agency insurance

- Office furniture distributor insurance

- Food distributor insurance

- Manufacturing insurance

- Yoga studio insurance

- Personal trainer insurance

How we calculate your business insurance cost

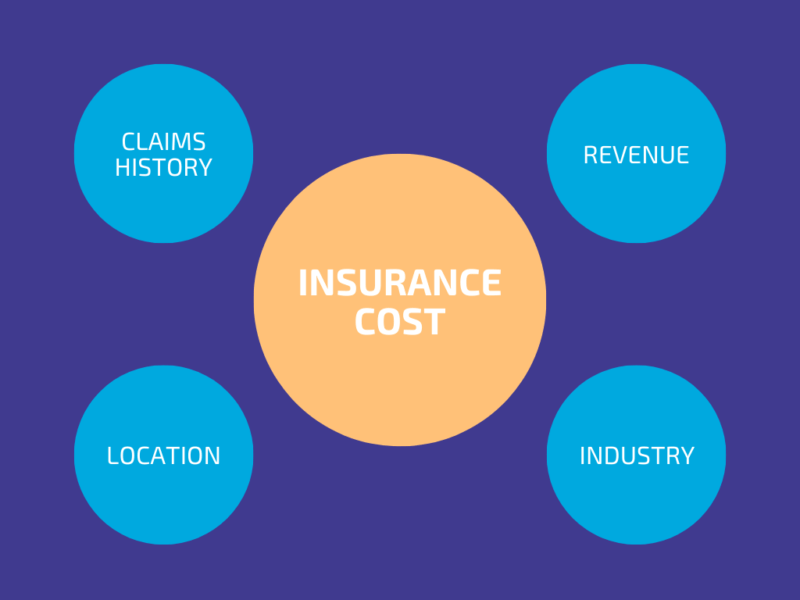

In a nutshell, there are four main factors used to calculate your small business insurance quote:

- Annual revenue

The more you sell, and the more stuff you make, the higher your insurance premium will be due to the increased likelihood of causing third-party damage. It’s all in the numbers.

- Industry: The type of product or service you sell

Some industries are higher risk than others, such as the example above, and this will be reflected in the premium you pay.

- Office location

Areas or neighborhoods that have higher crime rates or extreme weather can affect your small business insurance cost because technically, you’re at a higher risk of theft or incurring damage to your contents.

- Claims history/experience

The longer your business goes without claims, the cheaper your insurance rates will be because you are proven to be low risk.

What does business insurance cover?

Before we dig into coverages that can benefit your company, keep in mind any of these protections can be purchased as stand-alone policies.

Commercial Liability insurance

This covers you for any bodily injury or property damage that you, your employees, or your product could cause to a third party, such as your customers or another business.

Your landlord will often require liability if you are renting your space since they want to make sure that you are insured in case you cause damage to their building.

General Liability limits generally range from $1,000,000 to $5,000,000, but a liability-only policy can cost as little as $500 per year.

Some factors that will determine your small business liability insurance costs:

Professional liability

For companies that offer services – errors & omissions insurance covers your corporation against claims arising out of business or professional practices such as negligence, malpractice, or misrepresentation.

Commercial property insurance

Includes insurance for buildings, equipment, or inventory that your business owns.

The perils insured can include fire, theft, vandalism, water damage, earthquakes & more.

The minimum cost for your business contents (products, equipment, stock, etc.) is usually around $75 per year.

This $75 insurance cost will generally cover about $20,000 worth of business contents.

If you’re a Quebec landlord you’ll need either normal building insurance or short-term rental insurance, depending on your situation.

Factors that may increase the rate you pay for your contents:

- If your contents are easily damaged (ex: glass, textiles)

- If your contents are targeted for theft (ex: sporting goods, small electronics)

- If your neighbors are considered high-risk (ex: bars, manufacturers)

- If your building catches fire easily (concrete vs. wood)

Commercial vehicle insurance

If a vehicle helps an employee perform tasks related to their job, then it’s a commercial vehicle and should be insured accordingly.

To simplify, you need a commercial auto insurance policy if your employees conduct:

- Daily trips to visit clients

- Transport merchandise or materials

- Make deliveries

The commercial auto policy should be registered to the name of your business and needs to carry a commercial license plate.

Business Interruption

This covers your lost profits, fixed costs, and administrative salaries during the period your business is forced to shut down due to a covered claim.

Again, premiums for this protection can be as low as $75 per year, and increase in cost as you increase the amount of coverage.

The same factors that influence the property coverage influence the cost of business interruption insurance, since the two are usually claimed together.

Cyber insurance

Provides coverage against the effects of an unauthorized breach of your systems by a third party.

In other words, it’s insurance for when you get hacked.

To summarize, the right cyber insurance policy will cover your business for:

- Breach notification costs (advise your clients of the cyber attack by registered mail)

- The cost to re-create lost data

- The cost to repair your IT systems

- PR costs to repair your brand image

A cyber insurance policy for small business generally costs between $800 – $1,200 per year.

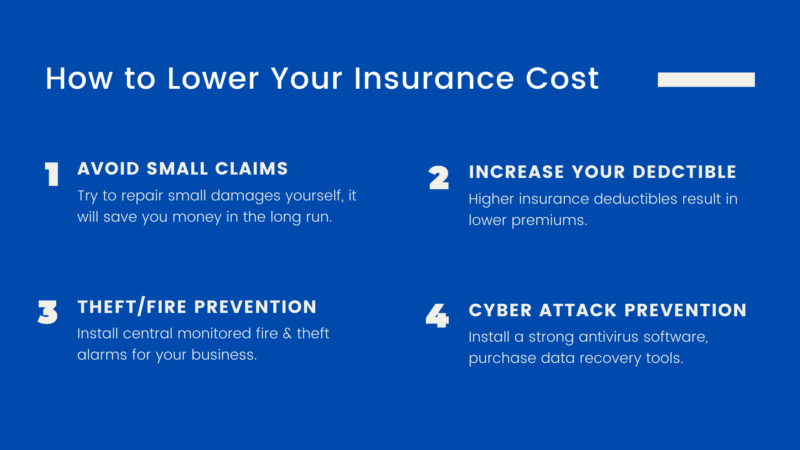

How can I lower my small business insurance cost?

Here are some pointers to help keep your small business insurance premiums down as your company grows:

Avoid claiming for small damage

Try to repair the little things yourself, because each time you claim, your insurance premium will increase.

Frequent claims unfortunately result in paying more for your insurance over time.

In many cases, the increase in your premium will be more than the actual claims themselves!

This is why it’s best to claim for significant damages; ideally, we suggest against claiming anything under $2,500.

All small business insurance companies offer discounts to those who are claim-free.

Raise your deductible

By increasing your deductible, you are decreasing the likelihood of making a claim, since there is a more substantial amount of damage that needs to occur before making a claim is possible.

Insurers will offer discounts each time you raise your deductible.

For example, raising your deductible from $1,000 to $2,500 would give you a 5% annual discount (with most insurance companies).

Install alarm & sprinkler systems

Small business insurance companies offer credits to organizations who use central monitored alarm & sprinkler systems since they can help mitigate damage.

While it may not be feasible for you to install a sprinkler system if you don’t own your building, pay attention to this when choosing a new office locale.

Install antivirus software & create a “disaster plan”

Be proactive and develop a disaster plan that prepares your company for cyber-attacks or data breaches.

Creating a detailed list of what to do in the event of a cyber breach can literally save your business.

Does my home insurance cover my small business?

If you’re a small business owner operating your company out of your house, you may be eligible for “home business coverage” through your residential home insurance provider.

This is an add-on to your home insurance policy, and it covers your business’ contents and general commercial liability.

The additional premium for these protections can be as low as $150 per year.

Industries eligible for home-based business insurance include:

- Professional offices (lawyers, accountants)

- Animal groomers

- Hairdressers

- Estheticians

- Music teachers

- Daycares

- Some small fabrication & distribution businesses

If you are thinking about starting a business from home, remember to advise your insurance provider!

Amazon seller insurance

If you sell in high volumes on Amazon, you need to treat that venture like any other business — and that includes getting business insurance.

Not everyone realizes that on a Pro Merchant account (for high volume sellers), Amazon requires you to carry liability insurance.

The problem?

Business insurance can be hard to find for e-commerce distributors.

The main reason: High U.S. sales.

Because of Americans’ propensity for suing each other, a lot of insurance companies aren’t jumping at the opportunity to work with businesses selling lots of product in the States.

At KBD, we receive a lot of first-time insurance buyers.

Lack of insurance experience is another thing insurers don’t like to see.

So a lot of Amazon sellers can’t find reasonable insurance.

Thankfully, we can help you if you’re stuck.

We work with a certain insurance company out of London that loves to issue reseller insurance; it’s their bread and butter.

We place a lot of online distributors with them, and we can do the same for you.

Learn more about amazon seller insurance.

General contractors

Most of the general contractors we insure only require two types of insurance: Liability and a tool floater.

Commercial liability insurance covers contractors for bodily injury or property damage that you, your employees, or your product might cause to a third party, such as your customers or another business.

A tool floater reimburses you for stolen tools, no matter where the theft occurs, be it on the job site, at your office, or at home.

We also offer niche insurance products for contractors like builders’ risk and construction bonds.

Read more about commercial insurance for contractors.

Restaurants

Believe it or not, restaurants provide quite a high insurance risk.

Between kitchen fires, slips and falls, food poisoning, choking, and much more, there’s a lot that can go wrong both to your building and among your clientele.

If you’ve recently opened a restaurant and are looking for your first commercial insurance policy, you’re going to pay a higher rate than other established restaurants.

Restaurant insurance provides coverage for two main perils: Property damage and getting sued.

Read more about business insurance for restaurants.

Textile distributor

A textile distributor’s worst nightmare: Smoke damage.

Because such an incident can ruin an entire warehouse of merchandise — a potentially massive insurance claim — textile distributors can expect to pay higher insurance rates on their stock.

What else?

If you import shipments from overseas, you should ask your broker about ocean cargo insurance.

Find out more about insurance for textile distributors.

Advertising agencies

What can possibly go wrong for an advertising agency to have to submit an insurance claim?

Well, aside from the usual property and liability stuff any company would need, there’s the potential for web hacks.

Many advertising agencies we have relationships with have evolved into quasi web developers.

And that opens them to cyber threats.

Pro tip: Don’t host your clients’ websites on your servers. If they get hacked, there’s a good chance they’ll try and sue you. (Even if it’s not your fault, you’ll still need to defend the suit.)

Learn more about advertising agency business insurance.

Office furniture distributors

What do you need?

Commercial general liability insurance in case your company causes injury to another person or causes damage to their possessions.

And transit insurance, which covers goods while they’re between destinations.

Pro tip: If you distribute equipment and use third-party installers, always make sure to ask for a copy of their business liability insurance policy.

Learn more about commercial insurance for office furniture distributors.

Tradesmen

Here, we’re talking to welders, electricians, plumbers, woodworkers, painters, roofers, commercial cleaners, and more.

If that’s your line of work, you need two types of coverage:

Liability: In case you or your employees cause bodily injury or property damage to a third party.

Tool floater: In case your tools are stolen on the job site, at your office, at home, or anywhere else.

Learn more about business insurance for trades.

Food distributors

In the case of meat distributors, the big coverage is equipment breakdown insurance.

This covers you in the event your freezer breaks down and all your meat thaws and spoils.

Know that if you store a lot of frozen food products, an equipment breakdown company will make you install a freezer alarm, so you’re best to get that done before an incident occurs.

Learn more about food distributor insurance.

Manufacturing

Your biggest concern is product liability — and that’s included in commercial general liability insurance coverage.

Business interruption — replacing the lost revenue, fixed costs, and administrative payroll after a covered loss — is another good coverage to have.

Thanks to Americans’ love of suing companies, the more product you sell to the U.S., the higher your liability cost will be.

Learn more about insurance for manufacturers.

Yoga studio

Good news: Insurance companies offer super affordable coverage for yoga studios.

There’s not much that can go wrong.

Of course, there’s always the chance a client injures themselves during a session.

To cover themselves, studio owners should carry professional liability and commercial general liability.

Namaste.

Learn more about yoga studio & gym insurance.

Personal trainer

Personal trainers should carry professional liability and commercial general liability.

A lot of fitness-related injuries occur in the ‘grey area’ where it’s unclear whether it should be classified as a CGL claim or a professional liability claim.

For that reason, you should have both.

At KBD, we can insure big gyms with entire staffs as well as private trainers.

Learn more about personal trainer insurance.

Conclusion

With the internet at your fingertips, and business insurance floating around in your brain, reach out to get your small business insurance quote.

KBD is a broker specializing in small business insurance, located in Montreal and serving the provinces of Ontario & Quebec.

If you would like to get a detailed small business insurance quote for your company, call us today at 514-636-0002