Hands up if you want to sell products on Amazon, learned you need distributor insurance, did a quick Google search of Amazon seller insurance and wound up here.

Yeah, we have experience with cases like yours.

Big online retailers like Amazon require their sellers to carry commercial general liability insurance.

As of September 1, 2021, all Amazon retailers that sell more than $10,000 in one month are required to carry product liability insurance and name Amazon as an additional insured.

Most customers that call us are looking to purchase business insurance for online retailers.

Whether you’re here for Amazon seller insurance in Canada, Shopify retailer insurance, commercial property insurance for your warehouse, or something else related to your wholesale business, read this post to educate yourself about the coverage, why you need it, and what it can do for you.

At the end, we’ll explain how to get it and why KBD can get you the best possible reseller insurance.

Here’s what we’ll be covering in today’s blog:

- What is wholesale distribution insurance

- Wholesaler & distributor product liability explained

- What’s included in a reseller business insurance policy

- How much does distributor & wholesaler insurance cost?

- Why you need customized wholesale distributors insurance

What is wholesale distribution insurance?

As a wholesale business or distribution company, your insurance policy is your safety net to catch you when things go off the rails.

Your insurance coverage ensures that if a product you’re involved with results in an insurance claim, or if disaster strikes your workplace, it doesn’t put your operations in financial danger.

Wholesalers insurance can cover your brick and mortar warehouse just as it can protect your online store.

And if you’re here because you want to sell on a third party online platform that requires you to have insurance, we’ll explain what you need.

As with any business insurance, wholesalers insurance can protect your assets in the event of a fire, help you escape astronomical legal fees, and get you out of a jam if someone else is injured as a result of the goods you sell.

Wholesaler & distributor product liability explained

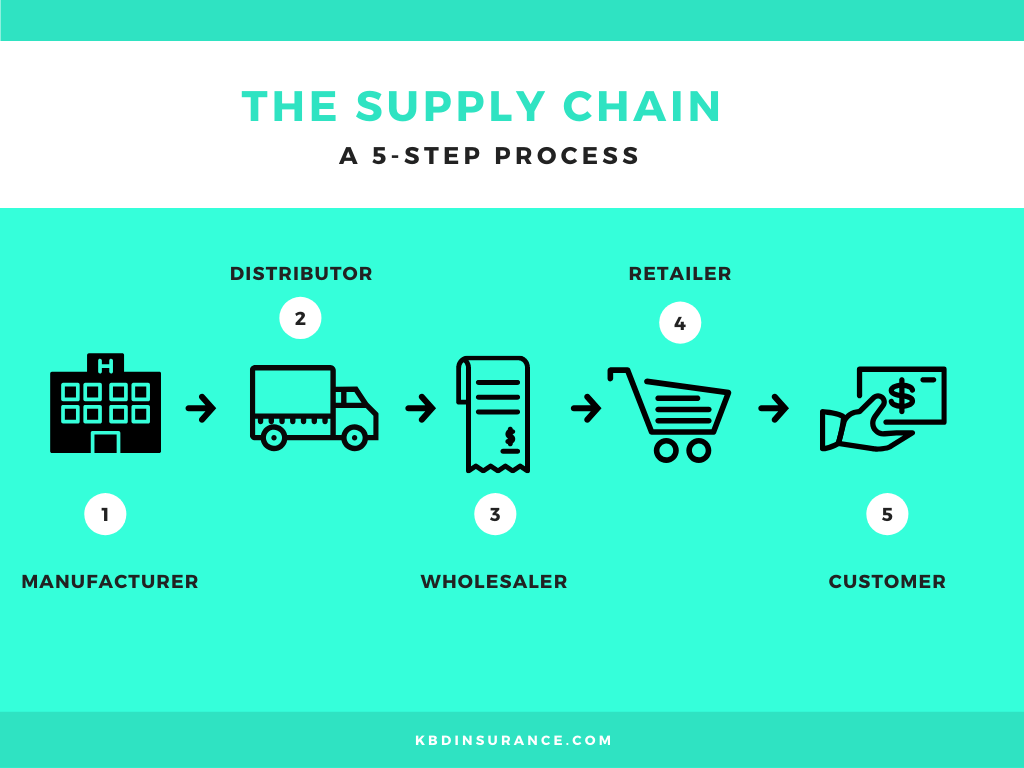

Being a distributor and/or reseller means you buy the finished product and sell it to someone else; you’re the middleman.

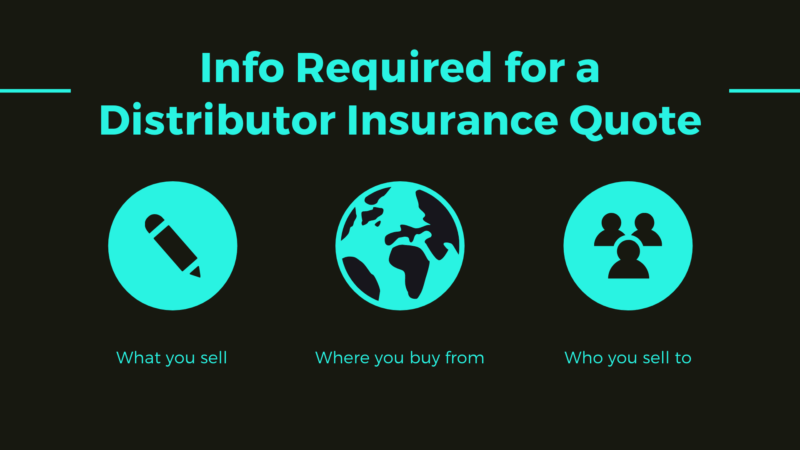

As commercial insurance brokers, we’re interested in knowing where you buy your product, what you sell, and to whom.

These three questions all pertain to product liability.

Let’s break down each question and why we require this information to provide your business with insurance quotes.

Where you buy your product

Let’s start this explanation with an example.

Here’s your supply chain network.

You’re the distributor, and you sell chainsaws that are made in China.

One day, the chainsaw cuts off the finger of a Canadian customer due to a product default.

Which company in the supply chain would be held responsible?

In other words, which company in the supply chain would be forced to pay for the damages?

This is what would happen:

Each company in the supply chain network would attempt to pass the fault onto the seller.

The retailer would blame the distributor, followed by the distributor blaming the manufacturer.

After all, it’s the manufacturer’s duty to test the product for quality assurance and safety.

Right?

Well, it depends.

The liability claim would be easily passed onto a North American manufacturer, but not a Chinese manufacturer.

Here’s why.

The Canadian gentleman who had his finger severed isn’t going to go to China to sue the manufacturer.

Different laws, different language & different cultural norms.

It would be too hard to sue a company in China, therefore the “fault” would move to the next company in the supply chain: the distributor.

All of this to say, when you import products from countries like India and China, you (the distributor) become the manufacturer in the eyes of the insurance company.

This is why wholesalers who sell high-risk products imported from China pay higher insurance premiums.

What you sell

The product you sell will also have a large impact on a wholesaler’s insurance price.

For example, you’ll pay less in insurance if you sell office furniture versus if you sell party balloons (high risk, since children can choke on balloons).

Whom you sell your product to

This concept is simple:

The more products you sell to the USA, the more you pay in insurance.

America is a very “litigious” society which means they sue often.

Your product liability insurance rates can be in some instances 10x higher if you sell to the USA.

What’s included in a wholesaler and distributor business insurance policy?

Let’s look at 6 insurance protections you need as a company in the wholesale trade business:

Pro tip 👉 you can purchase any of the following protections à la carte.

Marine Cargo Insurance

If you’re a distributor that imports your products from overseas, marine cargo insurance will cover them while being transported by sea or by air.

You can also add on an extension so the policy covers your contents while in transit.

Product Liability

Product liability covers you in the event you are legally obliged to pay for third-party damage.

In other words, this insurance will cover your business if one of the products you distribute causes damage to someone or something.

Commercial Property Insurance

This type of insurance works exactly like home insurance; it covers your distribution business against fire, theft, vandalism, floods, earthquakes and more.

Commercial automobile insurance

You’ll need this coverage if you have salespeople on the road & if you make small deliveries.

Commercial automobile is not to be confused with transport insurance.

Transport insurance is for very large deliveries of goods.

Business Interruption Insurance

This covers you for loss of profits, fixed costs, and administrative payroll after a claim event.

If your business suffers from a covered loss, (like a fire) business interruption insurance will also pay for your lost profits while the business is shut down to make the fire repairs.

Cyber Insurance

Distributors & wholesalers rely heavily on their computer software to keep track of orders.

In today’s digital era, who doesn’t?

Cyber insurance covers your company from cyber hacks and is very affordable for smaller sized distributors.

If you’re an e-commerce distribution company, having a cyber insurance policy is absolutely critical as the majority of your business is transacted online.

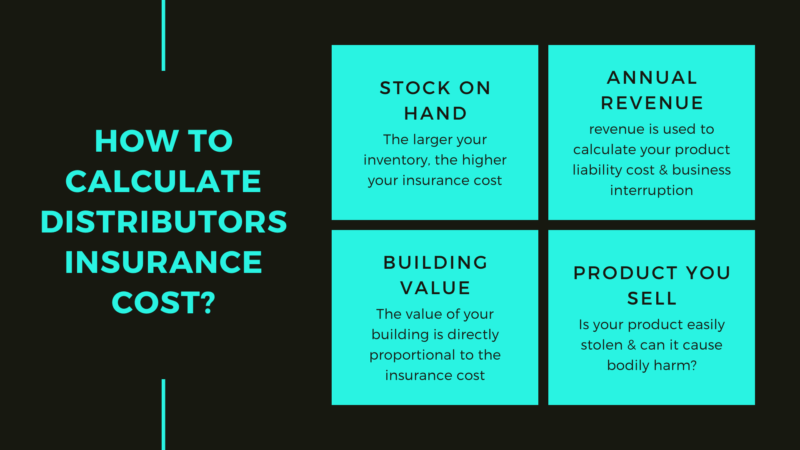

How much does distributor & wholesaler insurance cost?

KBD offers policies starting at $800 per year.

As with all other insurance products, there is no one-size-fits-all when it comes to how much reseller insurance costs.

How much you will pay in premium depends on a few factors:

- Amount of product/stock you keep on hand in your warehouse

- Annual Revenue

- Reconstruction cost of your building

- Type of product you sell

Factors 1 through 3 are pretty straight forward; the more stuff you need to insure, the higher the cost will be.

But what about point #4?

The type of product you sell influences your business insurance premium for two reasons:

- If your product is a high theft item (example: you distribute cell phones)

- If your product is a high liability risk (example: you distribute ladders)

Why you need customized wholesale distributors insurance

Here are two chief reasons you need customized wholesale distributors insurance:

- Major online retailers say so (Amazon, Costco, Shopify, etc)

- Lawsuits suck

The Big Boys

If you want to distribute products online — whether that’s on a third party site like Amazon or with your own online store powered by someone like Shopify — you’ll need wholesale distribution insurance.

The big players all require at least $1-2 million in commercial general liability insurance, and in some cases more (Costco requires its online retailers to have $5 million).

Why?

So they can drag you down with them!

We’re only half kidding.

Distributors are often baffled as to why they’re involved in a claim where they never touched the product and simply brokered a deal to get the goods online.

Spoiler alert: it doesn’t matter.

It’s easy to get pulled into a claim and once you do you need a lawyer which costs money…unless you have a policy.

That’s why you need liability insurance.

Lawsuits

Let’s say a consumer buys an electric saw on Amazon that you distributed to the online retailer.

The saw malfunctions and the user slices a finger.

Now they’re ready to sue and so they point the finger — sorry, couldn’t resist!

Chances are anyone involved in the supply chain, including Amazon as the retailer, you as the wholesaler or distributor, and the manufacturer, will all be pulled into a potential lawsuit.

With a lawsuit, the more parties you name, the likelier the case is to be settled out of court.

And a settlement is always beneficial because it avoids a long, ugly court battle.

Knowing this, Amazon requires its wholesalers and distributors to carry wholesale distribution insurance so that it can share the liability risk with you.

Lucky you!

Conclusion

As a wholesale insurance broker, protecting your business is our business.

To get a quote:

📲 Call KBD directly: 1 (514) 636-0002

We provide customized wholesale distributors insurance and can receive your quote and activate your policy all within 24 hours.

Premiums generally range from $800 – $5,000 per year, depending on your annual revenue.

As a rule of thumb:

Higher revenue = a higher premium.

The more product you have in circulation, the more likely an incident is.

Also know that higher risk products (and higher risk demographics, like infants) are more expensive to insure.

A tip for those just starting out: we don’t recommend starting off your distribution business working with baby pacifiers and power tools!

Lower risk goods will net you a more affordable insurance policy.

Whether you’re just starting out or you’re simply moving to a new online platform, make sure you have the best possible wholesale distribution insurance in your back pocket.

You’ll thank us later.