Because the data tells them to!

Actuarial data shows that people with higher credit scores claim less.

In fact, credit score is one of the top predictors of how good — and when we say good, we mean profitable — of a client one will be for an insurance company.

And the difference is astronomical.

People with good credit are more profitable to an insurance company than people with bad credit.

It sounds cold, but numbers don’t lie.

People with good credit claim less.

And people that claim less make money for the insurance company, while people that claim more cost them.

So it’s a big deal.

We could easily give you a fluffy explanation about how insurance companies care about their clients, but we won’t.

Of course insurance companies care about their clients.

But the truth is, the thing they care about most when it comes to their clients is how profitable they are.

Some people believe credit checks discriminate, but they don’t.

Large corporations are subject to the same credit checks as the rest of us.

Insurance companies simply want to know if the individual, or the company, pays their bills on time.

Here are some questions to be answered in today’s blog.

- Does getting car insurance quotes affect credit score?

- Does poor credit affect car insurance?

- Can you be turned down for insurance because of your credit score?

- Do all Quebec car insurance companies check credit?

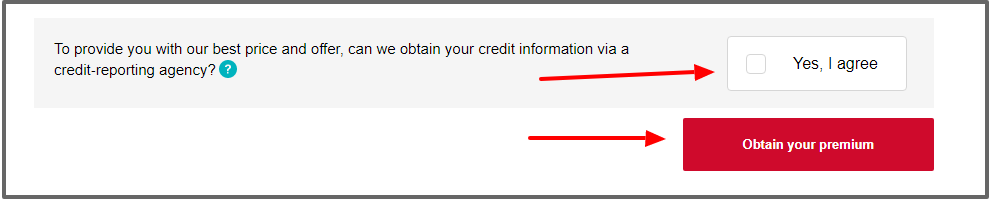

One thing to know as a customer: You CAN say NO.

But you probably shouldn’t — if you have good credit that is.

Insurance companies do require your consent before checking your credit.

They can’t just go ahead and check it on their own.

If you say no, however, they will assume poor credit, and that will be reflected in your insurance quote.

Today’s blog will focus on Quebec insurance companies in particular.

Some other Canadian provinces, like Ontario, have banned insurance companies from checking credit scores for car insurance.

In Quebec, for now, we still can.

Does getting car insurance quotes affect credit score?

No, getting a car insurance quote won’t affect your credit score.

A lot of people think credit checks affect your score, and that’s true to some extent.

But not in this case.

Because when an insurance company checks your credit score for a quote, it’s considered a ‘soft inquiry’.

Credit checks that are considered informational are classified as soft checks and won’t show up on your credit report.

On the other hand, when you’re shopping for a mortgage and the bank requires authorization to confirm that you’re eligible for approval, that’s considered a ‘hard inquiry’ — and that WILL affect your credit score.

For car insurance quotes, you have nothing to worry about.

But you should expect them to ask.

Every Quebec insurance company will request a credit check.

Every single one.

And while different insurance companies use different consumer credit reporting agencies — like Equifax and TransUnion — they all value credit score as a predictor of profitability.

Does poor credit affect car insurance?

Poor credit = Higher rates.

It’s true, the worse your credit, the more you’ll pay for car insurance, and home insurance too for that matter.

With some insurance companies, a bad credit score precludes you from the convenience of paying in monthly installments — they’ll force you to cover the entire premium up front.

Frankly, it’s expensive to have bad credit.

But it goes both ways! (Hehe.)

If you have great credit, the insurance companies will treat you well.

And we’re not talking about nominal savings.

I’ve seen quotes drop by as much as 50% after someone gave me their consent to check their credit score — because it turned out to be a good credit score.

It’s not complicated: With a good credit score, you can pay A LOT less.

Now don’t hit the panic button if you don’t have a great credit score.

You’re totally screwed if your credit score sucks.

There are other ways to keep your premium down:

- Increase your deductible

- Install telematics

- Start paying your bills on time!

Can you be turned down for insurance because of your credit score?

No, you won’t be denied insurance in Quebec due to a crappy credit score. It’s super rare anyways.

What’ll happen instead is they’ll offer you a much higher premium.

And there won’t be much you can do about it right away.

Over time, of course, you can work your credit score down to a reasonable level, and when your insurance is up for renewal, shop around to find the best rate you can find with your shiny new (or at least decent) credit score.

When your insurer does give you that high premium, don’t take it out on them.

It’s not really up to the person on the other end of the phone.

When they ask to check your credit score, they don’t actually see your score on the screen in front of them.

It’s a computer algorithm running in the background that will automatically add the surcharge to your policy.

So whatever rate you end up with, know that the credit score doesn’t lie.

Do all Quebec car insurance companies check credit?

They all WANT to check your credit.

They all ASK to check your credit.

But you ARE entitled to say no.

If you do, expect to receive a higher insurance quote.

And if you actually have a good credit score, then don’t try and hide it.

Let them check, and reap the benefits with a nice low insurance premium.

Wrap-up

The bottom line is that credit score matters when buying insurance.

The better score you have, the less you’ll pay.

Insurance companies don’t check it just for fun.

They use it as a main predictor toward how good of a client you’ll be — and that comes down to how much you’ll cost them.

It’s all about profit.

Of course, you can always refuse a credit check, but that’ll only lead to higher insurance rates as well.

At the end of the day, credit score matters in many walks of life.

Insurance happens to be one of them.