Sudden and accidental. Sudden and accidental. Sudden and accidental.

That’s the number one rule of water damage insurance.

Some types of water damage are automatically covered by insurance policies.

Others need to be added on as an endorsement.

We’ll get to all that.

Just know that no matter what, for an insurance company to pay out a water damage claim, it needs to be SUDDEN AND ACCIDENTAL.

A leak that’s been building in your roof for 4 years?

Not going to be covered.

Continuous water seepage will be a denied claim 10 times out of 10 — even if it’s invisible to the naked eye.

Even if it’s been building for months behind your walls giving you no indication of its existence.

It doesn’t seem fair, but that’s the way it is.

Pro tip: Learn how to shut off the water in your home!

Let’s say your toilet pipe explodes and water starts gushing out.

Don’t watch it fill the room while you wait for an emergency clean-up crew.

Step 1: Shut off the water. Then call for backup.

If it takes the crew hours to get there, that pipe leak isn’t going to stop and wait for them.

It’s going to wreak havoc on your house if you don’t nip it.

So before we go any further, go downstairs and find the switch.

Seriously. Now. GO!

Now that you know how to turn off your water, let’s look at what else you’ll learn today:

- Does property insurance automatically cover water damage?

- What is considered water damage for insurance?

- How do I claim for water damage on my home insurance?

- How much does insurance pay for water damage?

The information in this blog will pertain to home, condo, renters, and commercial property insurance.

Water damage insurance in Canada and in Quebec are basically identical.

We’ll see some differences between the U.S. and Canada further down.

For now, let’s look at our first question.

Does property insurance automatically cover water damage?

That depends.

As is often the answer to insurance questions, it depends on the situation.

When it comes to home insurance and water damage coverage, some perils are covered, and some are not.

The best indicator in water damage insurance is this: Did the damage occur inside or outside?

Inside = Good

Any water damage coming from within the home is automatically covered.

That includes pipe bursts that result in damage to the home’s structure or your personal belongings. (Of course, sudden and accidental still applies.)

More on this: Often, pipes burst in winter because homeowners shut off the heat and the pipes freeze and then thaw.

If that’s the case, your claim will probably be denied.

Homeowners shouldn’t turn off the heat in the winter — it can break their pipes.

The water, however, can be turned off when leaving the home for an extended period of time.

Outside = Bad

Water damage that emanates from outside the home is not automatically covered — but it can be added to your policy as an endorsement.

Above ground water damage is one of those perils.

And that includes moisture seepage through walls, roofs, doors, or windows, or overflow from the gutters.

Ground water, sewers, and overland damage is another endorsement you can add to your policy.

It includes sewer backups, foundation cracks that allow water in, and mass flooding.

In 2017, Quebec regulators decided they wanted insurance companies to cover overland water damage, which is mass flooding.

That’s why it’s grouped in with ground and sewer.

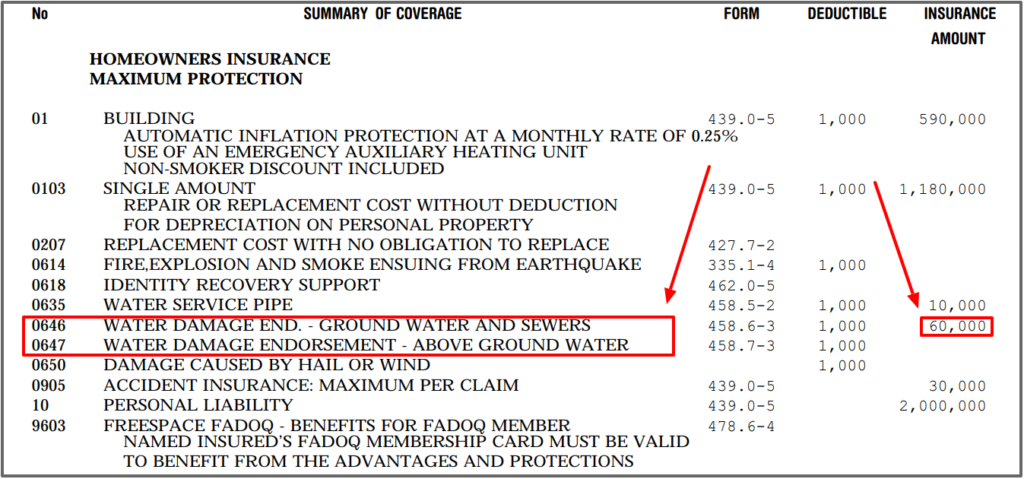

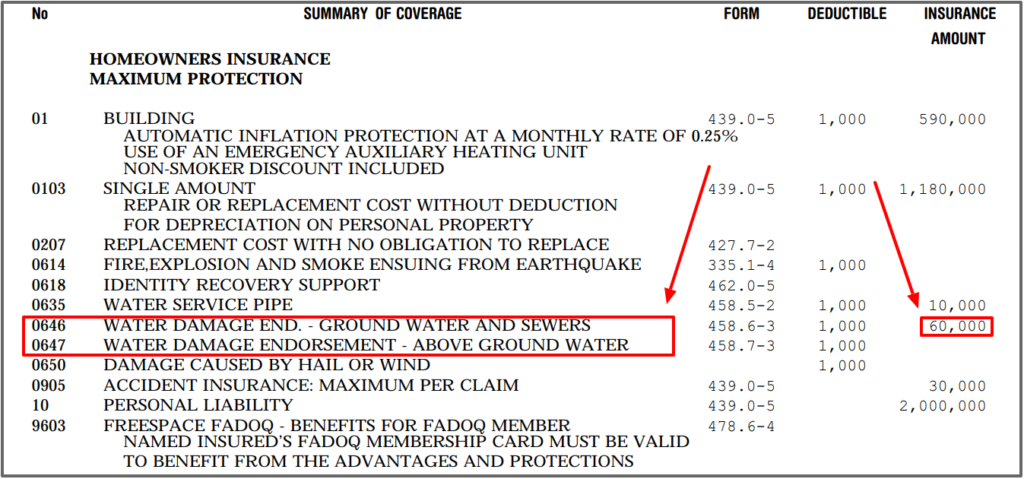

How do you know if you have the coverage or not?

You’d see the following on your policy:

You’ll probably notice that the screenshot doesn’t contain the coverage “overland” – that’s because this particular client lives in a flood zone in Pointe-Claire.

If you live in a flood zone, unfortunately you won’t be offered flood insurance in Quebec.

If you don’t live in a flood zone, most companies will automatically give you overland included with ground water & sewer coverage.

Commercial Insurance

There are two exclusions when it comes to commercial property insurance: Ground water and flood.

For commercial property owners, flood insurance can be purchased as an endorsement, but won’t automatically be included in the water package.

What is considered water damage for insurance?

It’s simple: If your physical property (building or contents) is damaged by water, insurance companies will deem it water damage.

The most common examples of water damage insurance claims are sewer backup, sump pump failure, and roof leaks.

Sump pump failure is one of the more frustrating claims we see.

Why?

It’s easy to avoid.

As a homeowner, there’s no excuse not to have a battery backup for your sump pump!

They’re not that expensive, and they can get you out of a costly water damage claim.

Think about it: What happens when there’s a huge storm and the electricity shuts off?

Your sump pump won’t work!

Water will be pouring into your home, and you’ll be helpless.

If you live in an area like Saint-Lazare, Quebec, which constantly deals with flooding, just get yourself a battery backup!

If you claim for water damage because your sump pump failed, you know what your insurance company is going to tell you?

Get a battery!

You’re better off getting one before that happens.

How do I claim for water damage on my home insurance?

Call your insurance company, and they’ll send a claims adjuster to assess the damage.

BUT, if the situation is urgent, weather the storm first.

If the water level in your home is rising a few inches every hour, call the emergency crew first and mitigate the damage.

You can always call your insurance company to submit your claim later.

But if you call the insurance company to make the claim first, it might be six hours before someone shows up.

By then, your home will be drowned.

Interesting tidbit: In the U.S., an insurance company will hand you a cheque so you can arrange to fix the damage yourself.

In Canada, insurance companies will handle it for you by sending a contractor.

In case of emergency, stop the bleeding first and claim later.

Your insurance company will ask for the bill to reimburse you at that point.

How much does insurance pay for water damage?

Once again, it depends.

What type of water damage did you have?

Let’s say your home is covered by Intact Insurance. Here are the limits you’d be subject to:

Water pipe bursts within your home: No limit.

Roof water claim: No limit.

Sewer back up/groundwater/overland: A limit ranging from 15k – 60k.

Any more than that and you’ll be paying out of pocket.

We’ll use the same screenshot from above to show how to find your limits, under the column insurance amount :

The insurance amount for ground water is 60k.

And because there’s no limit next to “above ground water” that means there’s no policy limit for that particular coverage.

Wrap-up

Water damage can be brutal.

If you’re in a flood zone, get yourself a sump pump battery backup — it can save you a lot of stress.

No matter where your home is located, learn how to turn off the water.

That can help you to mitigate damage quickly in case of an incident.

And remember the number one rule of water damage insurance.

Damage has to be SUDDEN AND ACCIDENTAL.

Otherwise, we can’t help you