What do celebrities and people with car insurance have in common?

Neither want to get cancelled.

It’s true — cancel culture is all the rage these days.

And if you’re not careful, you could get yourself cancelled by your insurance provider.

If you behave though, you can be the one that does the cancelling.

But walking out on your insurance policy can have consequences.

We’re here to help you navigate those muddy waters and avoid getting tagged with a bad reputation.

Just like the media, car insurance companies don’t soon forget!

So consider us your publicist for the next few minutes.

Now to the real subject at hand.

A car insurance policy is an agreement you have with your insurance company.

Think of it as signing a one-year contract. (In some cases two, but generally one.)

But sometimes you have to end that contract early.

There are many reasons for doing so, which we’ll get to later in the blog.

TABLE OF CONTENTS

- When to cancel your car insurance

- When NOT to cancel your car insurance

- Short rate cancellation vs pro-rata cancellation

- Getting car insurance after a cancellation

First, let’s define it.

What is a “cancellation?”

It’s when you terminate your contract before it’s over.

If you “cancel” on the anniversary that your policy began, that’s not actually cancelling.

That’s a “non-renewal.”

You’ve simply allowed your contract to expire.

So what happens when you have to pull the plug early? You pay a cancellation fee.

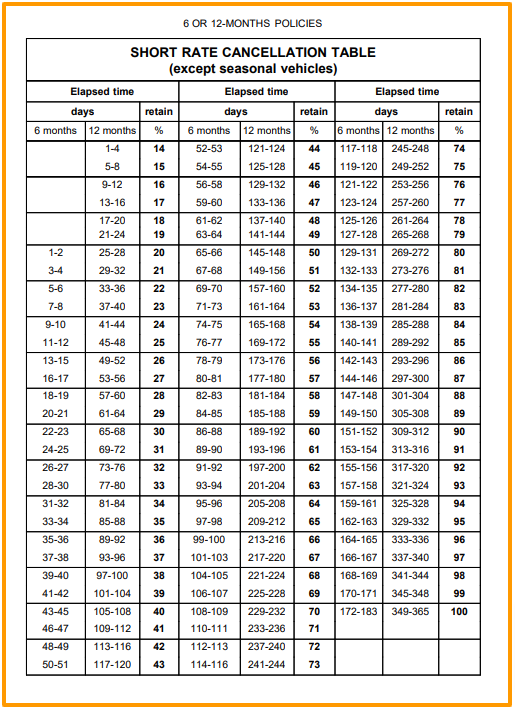

EVERY auto insurance contract includes a cancellation clause, it resembles the screenshot below.

Spoiler alert: They’re all the same.

Seriously.

Cancellation rates don’t change from one company to the next.

Every Quebec car insurance company follows the same formula.

Which is?

The typical cancellation fee is generally the equivalent of one month of your premium.

So if you’re paying $100/month for your vehicle insurance, you’ll pay a flat $100 cancellation fee.

That’s how we simplify it to our clients instead of using this table to go through complicated math equations.

Some clients are unaware of the cancellation fee up front and wind up feel like they’re getting screwed.

Well, if you think you’ll just jump ship and avoid a charge elsewhere, you won’t.

What you need to know then is how to avoid cancellation charges. The easiest way to do that is to wait until the end of your term before switching.

There are other circumstances in which you can avoid the charges, which we’ll cover throughout the blog.

If you’re looking for a “sneaky” way to pay less for your car insurance, you can enroll in telematics.

We wrote a whole blog about it, in fact.

If you’re not ready to talk cancelling, you can first check out our ultimate guide to auto insurance to inform yourself on auto insurance at large.

If you’re ready to go, let’s talk cancelling.

When should you cancel your car insurance?

There are a few scenarios in which it’s appropriate to cancel your automobile insurance and can avoid charges.

- Without a car

If you sell your car and don’t plan on replacing it, then obviously you no longer need car insurance. In this case it’s likely worth eating the charge instead of paying for auto insurance you don’t need.

- Moving out

Any time you move to a new province, you’ll have to get a new insurance policy. Whatever license plate you have on your car has to match your insurance provider. So if you have a Quebec plate, you need to be insured by a Quebec company, and so on.

- Save by switching

When it’s time to renew, it’s always smart to shop around and see if you find a better rate somewhere else. If that’s the case, do it. But if you wait until the end of your contract, you won’t pay cancellation fees. That’s a win-win.

Anyone else picturing that little gecko telling you to save 15% or more on your car insurance by switching to GEICO?

No — just us? Okay, cool.

When should you NOT cancel your auto insurance?

There’s a popular scenario in which most people think they should cancel their car insurance — but they shouldn’t.

Say you’re selling your car and are getting a new one, but not right away.

You’ll be without a car for one, two, or three months.

What do you do?

Save some money by cancelling and take advantage of an insurance gap, right?

Wrong.

By cancelling, you incur the aforementioned rate of one month of your premium.

Let’s say you pay $1200 / year for your policy.

You pay a $100 charge. Not terrible, but still unnecessary.

Now, let’s say you know about a little something called the storage endorsement.

What’s the storage endorsement, you ask?

It’s designed for people that have a “summer car.”

You know, the guy with the big house at the end of the block who pulls out his Ferrari every April after the snow melts, then puts it away in November.

That guy (or gal) has an expensive whip sitting in his garage all winter long without touching the road.

Sure, he’s made of money — but he still doesn’t want to pay an unnecessary monthly cost for auto insurance.

So he gets what’s called a storage endorsement, which strips collision coverage and allows him to pay for only fire, theft, and vandalism at just 15-20% of his original rate for the months his car is off the road.

On that $100/month policy, that’s just $20 for every month you’re carless.

What does this have to do with you?

It’s perfectly legal for you to snag that coverage for your imaginary friend of a car during the time your driveway is empty.

And why should you?

Because paying $20 instead of $100 is pretty damn worth it.

Short rate cancellation vs pro-rata cancellation

There are two types of insurance policy cancellations to know about.

Short rate cancellation

If you terminate your contract mid-term, you’ll have to pay a cancellation fee.

Pro rata cancellation

Indicates a full refund (or free transfer) of any unused premiums.

Here are two examples of the latter:

- You get a new car and give your existing one to your daughter, who will stick with the existing insurance company. Under a pro rata agreement, some insurance companies will allow this transfer at no charge. Beware: It’s an unwritten rule and not all companies abide by it. With KBD, you definitely won’t be charged!

- The insurance company cancels you. This can happen for any number of reasons, but if they’re the ones that pull the plug on you, you can expect a refund for your unused months.

Let’s say you move from Montreal to Toronto.

As we said earlier, you’d have to now get Ontario car insurance.

But in this case, you don’t do it.

When you go to make a claim, your Quebec insurance company won’t cover you.

Assuming it was an innocent mistake, they will refund you for unused insurance, but they still won’t pay your claim.

Some people do this intentionally to avoid Ontario’s more expensive car insurance.

But it won’t work.

Sure, you’ll pay less for insurance.

But it will be useless coverage.

So don’t think you’re pulling one over on anyone — you’re just screwing yourself.

Getting automobile insurance after a cancellation

How do you get car insurance after you’ve been cancelled by an insurance company?

Thankfully, it’s an easier recovery than being cancelled by cancel culture.

Here are some reasons your insurance company might be, like, so done with you:

- DUI

- Criminal Record

- Cancellation for non-payment by another company within the last three years

- High claims frequency

For any of these reasons, an insurance company might refuse to insure you.

Our friends at Intact Insurance have a “specialty” market for cases like this. (Specialty is the nice way to say it.)

Basically, they’ll insure you at a rate 30-50% higher than you’d otherwise pay.

At least you get insurance, though you’ll be paying through the roof.

The good news is, that’s not permanent.

Insurance companies look at what you’ve done over the last five years.

So if you’ve had a few good years in a row, there’s a light at the end of the tunnel.

Wrap-up

Come to think of it, some of the incidents described above (DUI, criminal activity) could get a celebrity cancelled too.

So in the end, getting cancelled by your insurance company and by social justice warriors is not that different.

At least now, you know what to do when it comes to car insurance.

If you get cancelled by angry Twitter folks… we can’t help you.