I always ask my clients to “imagine the worst thing that could happen to your business.”

Without fail, they tell me something horrific.

“Good,” I’ll tell them, “Now imagine that it’s just happened.”

That usually gets a small flinch out of them.

Then I ask my final question.

“You need to fix this as soon as possible so you can get your business running again. Are you covered?”

Those three words can change everything.

It changes the way you think and the way you manage your company.

No matter how out of the box your company is, the underlying truth is that it’s an asset.

How do you protect a catastrophe from shredding that asset to pieces?

Business insurance.

The amount of insurance you need for your business depends on the size of your company and how much risk you’re willing to take on yourself, but ask yourself this question:

Is there really a price tag on peace of mind?

Tell me, what is the worst possible thing that could happen to your business?

Is it a fire? A flood?

A lawsuit? Compromised client data?

Imagine this scenario playing out; could your business afford to pay for the damages out of pocket?

If the answer is “no,” then you should consider purchasing a commercial insurance policy.

Whether you’re a start-up or an established business that’s been around for years, having the proper coverage can ensure the survival of your company after suffering from an unexpected and devastating setback like a fire or cyber-attack.

What kinds of business insurances are available, and what are the factors that influence commercial insurance rates?

What does business insurance cover?

Different insurance policies cover different things. Here are some of the basic coverages available:

If your worst-case scenario is direct damage like fire, water damage, theft, vandalism, or damage to a physical asset like your building, furniture, or equipment, business property insurance is your new best friend.

Your business insurance policy will include improvements you’ve made to your space, such as putting in new displays or installing a hardwood floor.

These need to be insured for the dollar amount it would cost to replace them today, so an excellent place to start when calculating the value is your original purchase price.

The cost of this coverage is directly proportional to the amount that you insure: it costs more to insure $100,000 worth of goods than it does to insure $5,000.

Business Interruption Insurance

This covers you for loss of profits, administrative salaries, and fixed costs if your business is required to shut down due to a property damage claim.

You would be covered either until your location has reopened or until your operations return to normal.

It’s not necessary to insure your full annual revenue, since there are many operating costs that you wouldn’t incur during the shut-down, such as electricity and heating.

The industry standard for this coverage is 35% of your annual revenue.

Again, the cost of this coverage is proportional to your business income, and the premium increases with revenue.

Commercial General Liability Insurance

This covers you for any bodily injury or property damage that you or your products cause to a third party.

Many landlords require you to have a minimum of $2 million in liability insurance, in case you cause damage to the building.

This insurance also covers you for any damage your product could cause to the user, such as an allergic reaction or choking.

For this reason, some vendors will require manufacturers to carry a certain amount of liability insurance coverage for their products.

As with property insurance and business interruption, the price of this insurance is based on how much you want to cover.

Liability Insurance also considers other things.

For example, a company selling chemicals will pay more for liability insurance than a company selling brooms, since chemical compounds have much more potential to cause injury or harm.

A company selling $1,000,000 of a product will also pay more than a company selling $50,000 of the same product since with more stock out in the world, it is statistically more likely that something could go wrong.

Why should I buy business insurance?

While every business owner hopes they will never have to make an insurance claim, the reality is that circumstances are often outside of your control.

If you’re not adequately protected, an accident can result in substantial financial loss and force your business to close.

For a company just starting out, the cost of replacing physical assets might be possible out of pocket.

Still, as your business grows and acquires more assets, this will become increasingly difficult, so it’s essential to make sure you’re adequately insured.

If your business is heavily reliant on a physical location to operate, business interruption insurance is crucial.

Many companies operate on tight profit margins, and if your business is forced to shut down due to a fire, you’ll be put in a difficult situation.

The fixed costs (such as rent) may become unmanageable after several months of inactivity, so it’s important to include this in your business insurance policy.

For any business large or small, commercial liability insurance is an absolute must.

Lawsuits for bodily injury can result in rewards in the hundreds, thousands, or millions, which is enough to bankrupt even well-established businesses.

A business liability policy can prevent this from happening.

Even if you aren’t the manufacturer of the products that you sell, you could still be implicated in a lawsuit, and your insurer will be able to come to your defense legally and assist you in passing the suit on to the manufacturer.

The definitive guide to getting your business insurance quote online (in 10 clicks)

As business owners ourselves, we understand that your time is valuable, and calling up multiple insurance companies to receive quotes can feel impossible for your packed schedule.

As a commercial insurance broker, we realized that we needed to create a more efficient solution to this problem, which is why we provide online quotes from multiple insurance companies.

And the best part?

We can get it to you in as little as 7 minutes!

If you’re interested in seeing a personalized quote for your business, follow the steps below:

1) Visit the KBD business insurance quote web page

2) Click on the “get your quote” button

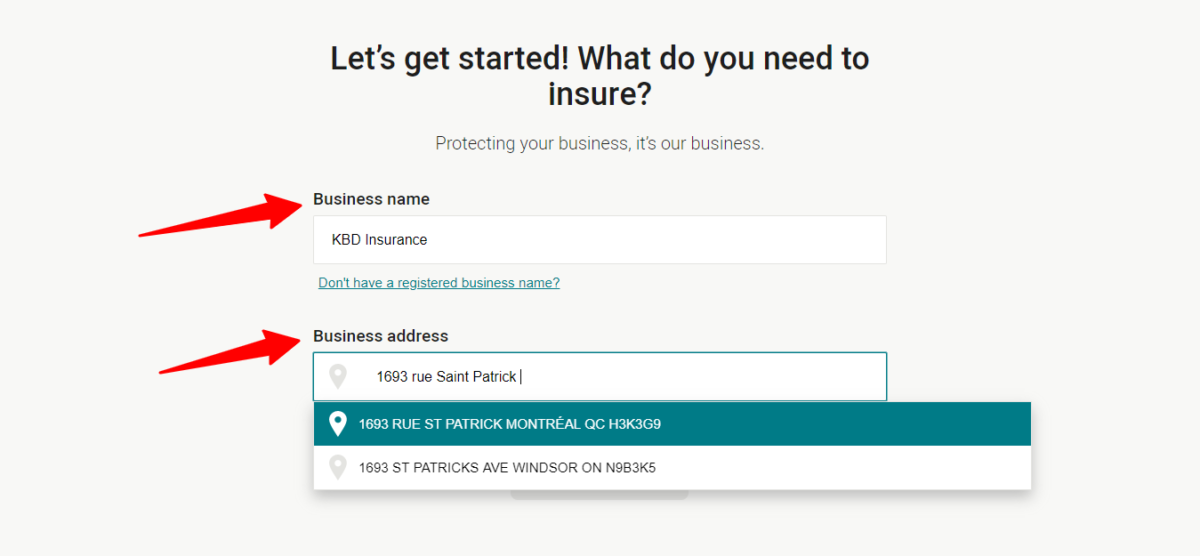

3) Start by filling in some basics

You’ll be redirected to a third-party web page: Intact Insurance.

We’ve collaborated with them to create an efficient platform for one reason: we value your time.

Fill in your company name along with the address and hit “next.”

Pro Advice

If, at any point in the process, you feel the need to speak to a broker or get personalized help, you can call us directly at this number: 514-695-7515

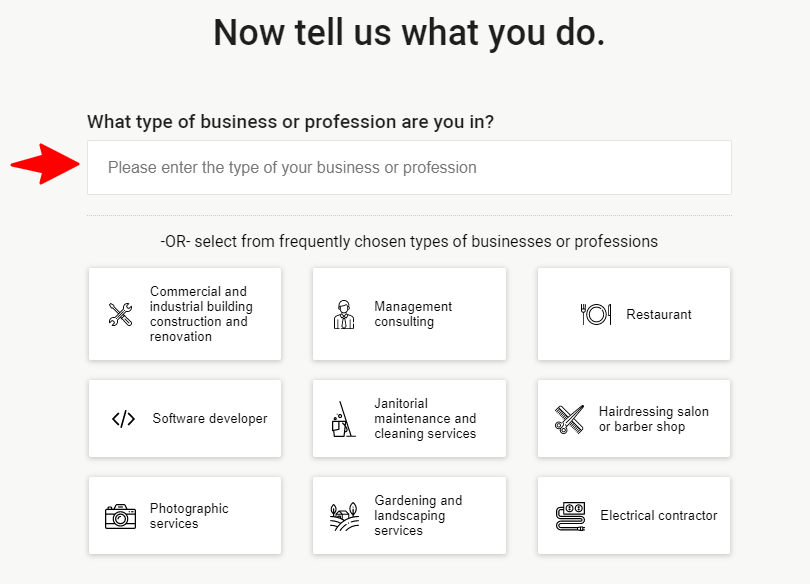

4) Type in your business industry or profession.

If you can’t find your industry, don’t worry; it doesn’t mean we can’t provide your company with a business insurance quote.

The program will prompt you to enter your email address and your phone number, and one of our commercial insurance brokers will call you back ASAP.

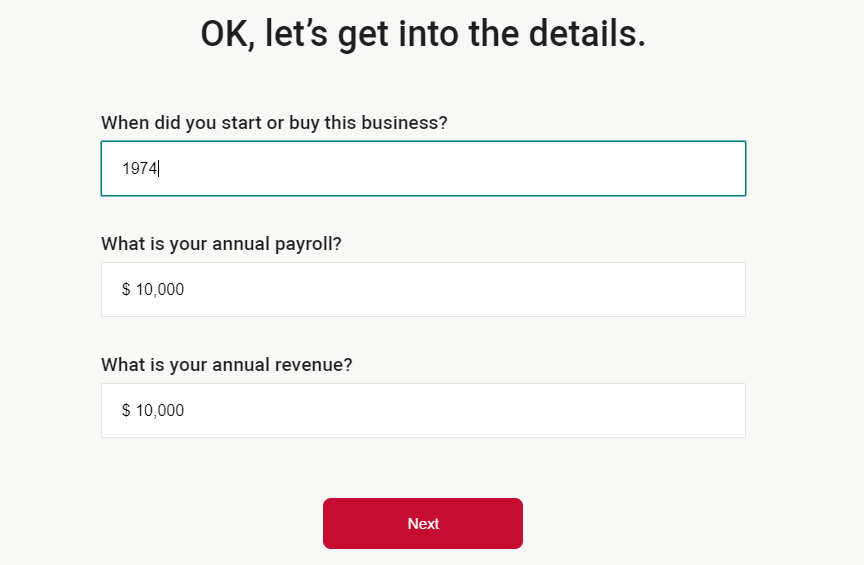

5) Let’s get to the juicy details

The year you started your business

The older your business, the more experience you have, which makes you a lower risk in the eyes of the insurance companies.

Your annual payroll

This is a question that pertains to business interruption protection; if you don’t know off the top of your head, don’t worry.

You can simply guess to the best of your knowledge and review this detail afterward with a commercial insurance broker.

Your annual revenue

The higher your revenue, the higher your premium will be as you have more products or services in circulation.

It’s best to put in your projected revenue for the upcoming year to get the most accurate price.

*INSURANCE BROKER TIP*

Always use a conservative figure when estimating your projected annual revenue.

If you think your business sales will be between $1 million and $1.1 million, take the lower amount.

You will not be penalized for such a small discrepancy; it will also help you get a more competitive business insurance quote.

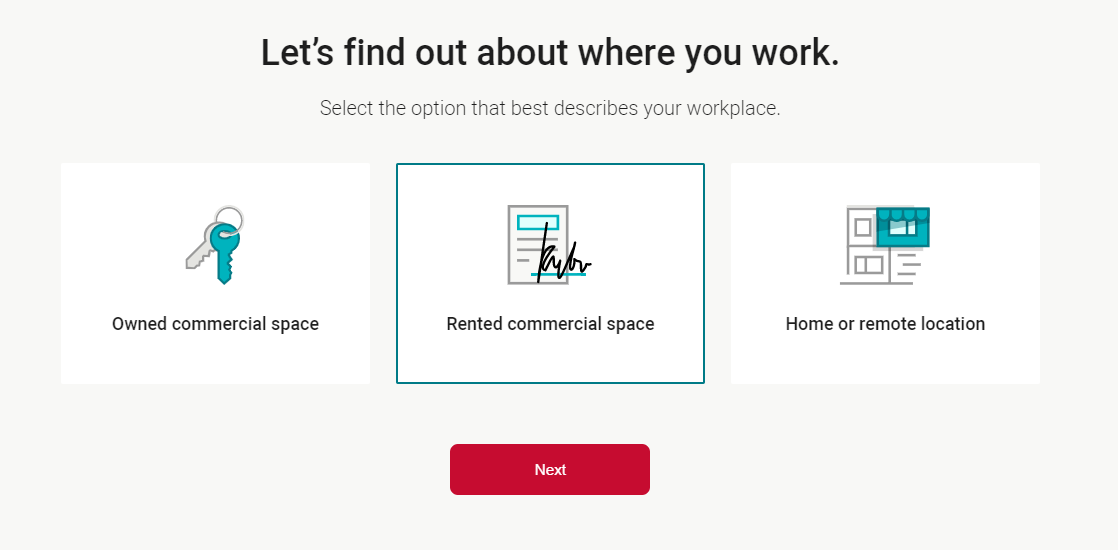

6) The type of space your business occupies and if you own or rent.

- An example of an owned commercial space would be a manufacturer who owns the building they work out of.

- Rented commercial space is when you pay rent to occupy your office or warehouse space

- Home or remote location is when you have an office or workspace set up from home, or if your employees work remotely.

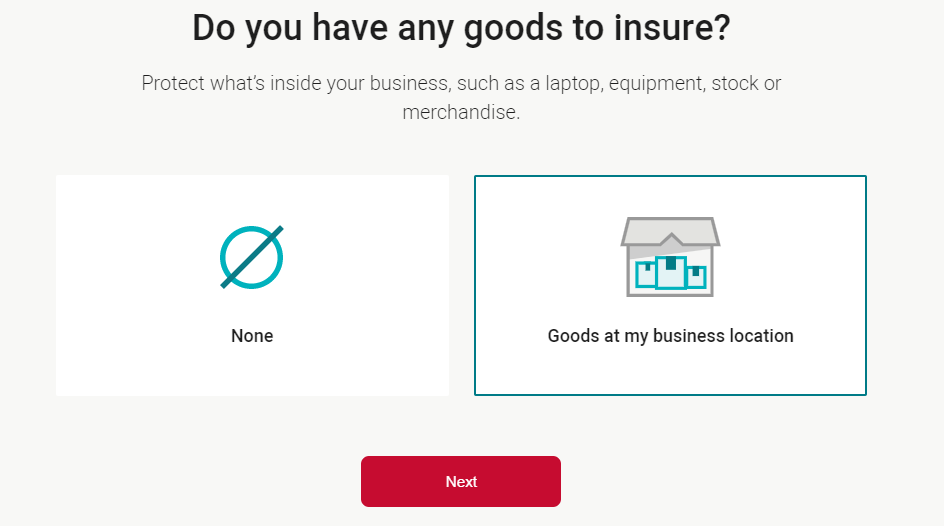

7) Does your business own any goods?

This question includes things such as office equipment, computers, office furniture, contractor’s equipment, warehouse materials, and other similar goods.

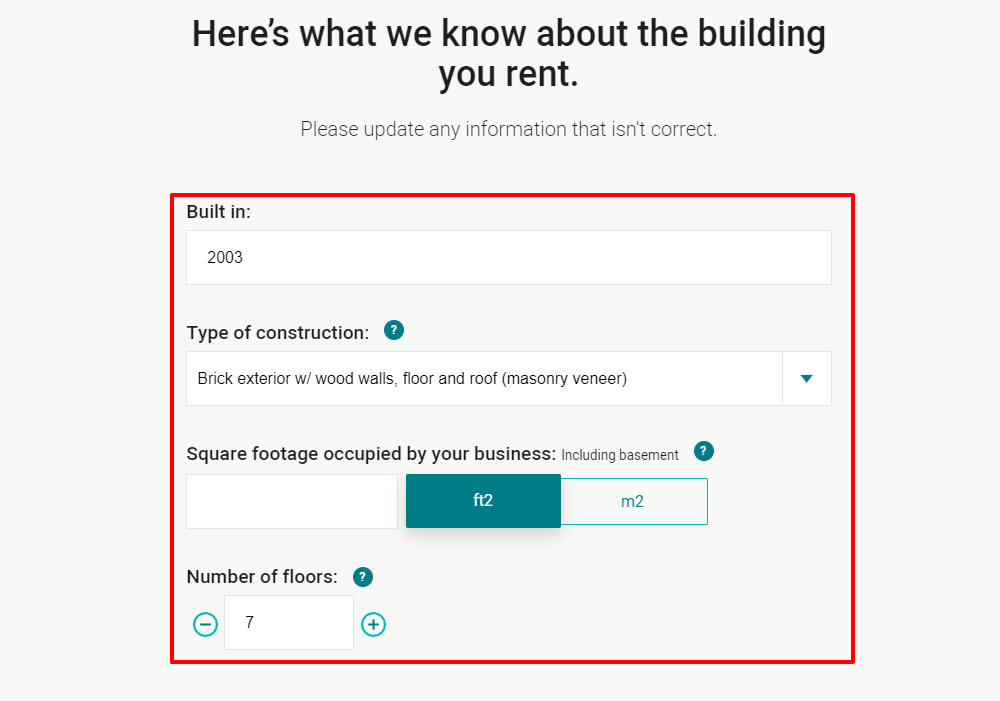

8) Information that pertains to your building or locale

If you’re like most of our clients, you probably don’t have a clue about the construction information of your building.

Don’t stress.

This page will automatically fill in your building information, provided you enter the exact address of your business location.

Thanks to the extensive database on Canadian homes and buildings, our online business quote platform will know the year your building was built, what the walls are made of, and the number of floors in the building.

Isn’t technology great?

The only question left for you to fill out is the square footage of your space, which will be included in your lease or your building evaluation.

If you’re not sure, or just don’t have the time to find the exact answer, you can guess and change it later.

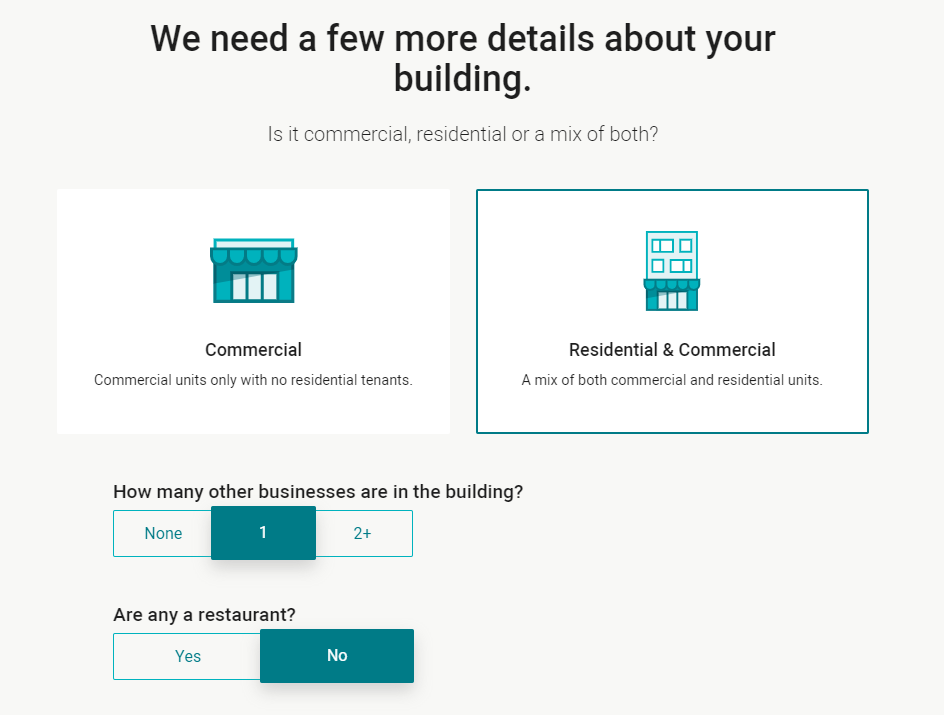

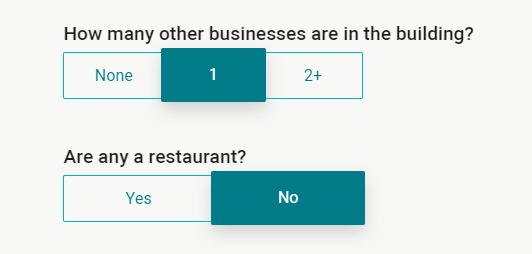

9) Who are your building occupants?

Are the tenants in your building companies, or is there a mix of businesses and people living in your edifice?

9.a) Other businesses in the building:

At the bottom half of the page, you’ll notice it asks if there are any other businesses in your specific building and if they are a restaurant(s).

It’s important to know if restaurants are in the building as they can change the dynamic of your insurance situation.

It doesn’t mean you’re not insurable, and it doesn’t even mean your rate will be more expensive; however, it is something an insurance underwriter will ask more questions about.

If one of the tenants in your building is a café, you have nothing to worry about, and it won’t increase your online business insurance quote, but having a nightclub as a neighboring tenant will most likely increase your price.

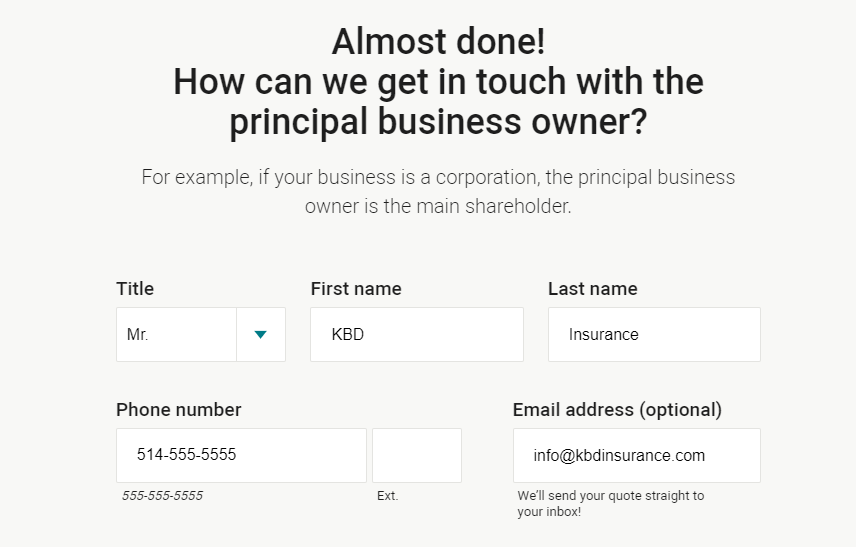

10) Fill in your contact information to receive your online business insurance quote!

If you’re like us, you hate giving away your name, email and contact info before you know if the product or service can benefit you or your company in some way.

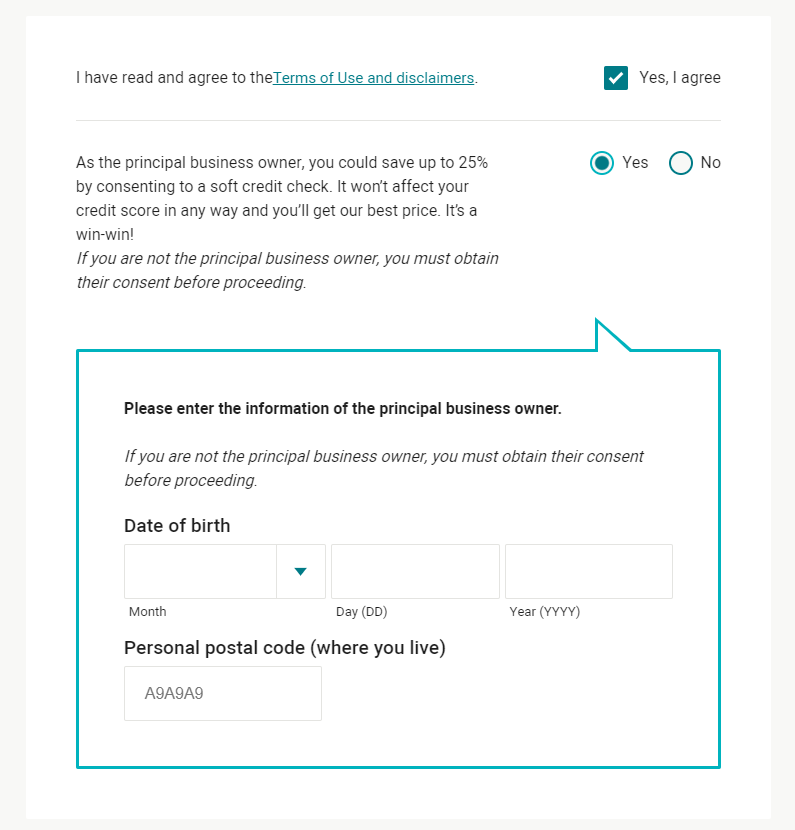

After all, the goal of this exercise is to save money on your business insurance. The reason we ask for your info is to perform a credit check.

But how can this benefit you and provide you with the best online business insurance quote?

First and foremost, this information remains confidential, and we absolutely won’t use it for remarketing purposes.

By entering your date of birth, home address, and consenting to a credit check, you can save an additional 25% on your insurance premium.

Why?

Insurance premiums are determined by statistics, which show that the better credit you have, the lower the chance you have of making a claim, which results in a better business insurance quote.

If you’re still uncomfortable with the idea, feel free to give us a call, and an insurance broker will help ease your worries.

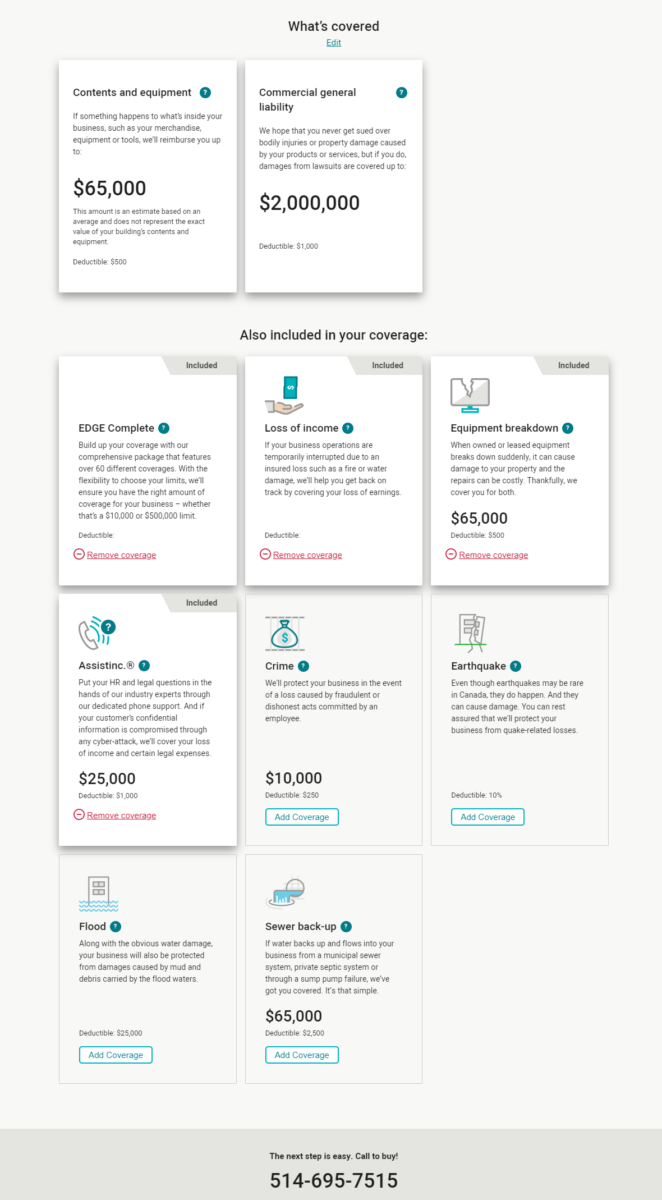

11) Tailor your coverage and call KBD Insurance!

Once you’ve completed your business insurance quote online, you’ll get the monthly or yearly price, the direct phone number to get in touch with a commercial insurance broker, and a broad overview of what protections are included in your policy.

It’s essential to keep in mind that the online business insurance quote needs to make certain assumptions; therefore, your price may not be 100% accurate.

For example, the amount of the contents is calculated based on the square footage that your company occupies.

If the number is inaccurate, it could affect your premium.

You can modify the coverages yourself or call us directly.

Conclusion

The amount of insurance your business needs depends on several factors; it’s not a simple “this much” or “that much” answer.

It all depends on how much of a financial loss your company can absorb, or how much risk your company is willing to take on itself.

Most businesses purchase all the business insurance coverage they need and factor it into their yearly budget.

This way, they have peace of mind when the unexpected happens.

If you’d like to find out more, speak with one of our business insurance brokers today!

Or, if you’d like to get a quote online, click here.