No, your Quebec renters insurance policy does not cover your roommates automatically.

And when disaster strikes at the apartment, it’s crucial that both roommates are prepared.

Does anything say being in your twenties like having a roommate?

Whether it’s your first off-campus apartment near Concordia or McGill or that downtown Montreal loft that finally got you out of your parents’ house, having a roommate is awesome — until it’s not.

Most people that have roommates are at a point in their lives when they’re young and, frankly, stupid.

Irresponsible.

Chances are you’ll do dumb things at your apartment, and that’s why you need renters insurance.

Hopefully you’re smart enough to have gotten renters insurance for your new apartment already.

Your roommates?

They probably assumed your insurance policy covered everyone in the apartment.

They’re wrong.

If you want answers to any of the following questions, keep reading.

- Can you use someone else’s renters insurance?

- Should I add my roommate to my tenant insurance policy?

- Is renters insurance per person or per unit?

- How do I add someone to my renters insurance policy?

Renters insurance covers immediate family members that live in the same household as well as significant others.

A renters insurance policy will NOT cover your roommate’s belongings or liability.

Not automatically, at least.

There is a way to get your roommate covered under your policy, and that’s to add them as an additional named insured.

All that means is that they’re someone other than the policyholder and are covered by the policy just the same.

If your tenant insurance policy has only your name written on the official documents, your roommates won’t be covered.

There’s typically no issue in adding a roommate’s name to a renters insurance policy.

Beware, though, there is the odd insurance company that might require you to purchase a separate policy.

Just call and ask.

Can you use someone else’s renters insurance?

Nice try, but no.

Any name that doesn’t appear on a policy shouldn’t expect to be insured in the event of an incident.

In order to insure someone on a policy, much like the owner of Hop Sing on Seinfeld, WE NEED A NAME!

Renters insurance is designed to protect YOUR personal belongings exclusively in the event of fire, theft, water damage, and more.

Should I add my roommate to my tenant insurance policy?

There are pros and cons!

There’s the added apartment insurance cost, and we’re here to tell you that on cost alone, it’s damn worth it.

Adding a roommate to your renters insurance policy normally costs $15-20 extra… per year.

So that shouldn’t be what dissuades you.

Pro: Save money. Aside from that miniscule added cost, you now get to split your cost of insurance down the middle, or divided among however many roommates you have.

Con: Claims affect everyone. What we mean is that once you have a shared policy with a roommate, their claims are yours and vice versa.

If your roommate submits a claim for, say, a stolen laptop that had nothing to do with you, that claim will stay on your record just as it will theirs.

Claims stay on your record for five years and raise your premiums.

So if one of you has to submit a claim, does that mean you’re SOL?

Not exactly.

Listen carefully.

One thing you can do if your roommate submits a claim and you want it off your record is this.

When your policy expires, ditch that insurance company and shop policies elsewhere.

When they ask you whether you’ve had a claim in the last five years, you say no.

Of course, we don’t endorse lying to your insurance company.

You shouldn’t do that.

But this isn’t lying.

If your roommate made the claim and not you, then you can truthfully answer “no” to the question.

This loophole is possible to exploit because, unlike with car insurance, home or renters insurance leaves no trail.

Insurance companies have no database to draw on, so your claims don’t follow you around.

Again, it’s not lying as long as you can honestly say it wasn’t YOU that made the claim.

So keep it truthful, but definitely take that shortcut when you can.

Is renters insurance per person or per unit?

Q: When I purchase a renters insurance policy, am I insuring a person or am I insuring the unit?

A: Your renters insurance policy covers one particular individual — you.

So if one policy doesn’t cover everyone in the unit, do both roommates need renters insurance?

Yes.

That’s why your roommate wouldn’t be automatically included on your policy.

And that’s why you have to add them by name to ensure they are covered.

How do I add someone to my renters insurance policy?

📞 Pick up the phone.

Adding a roommate to your insurance policy is as simple as calling your broker or direct insurance company and asking them to add your roommate to the policy.

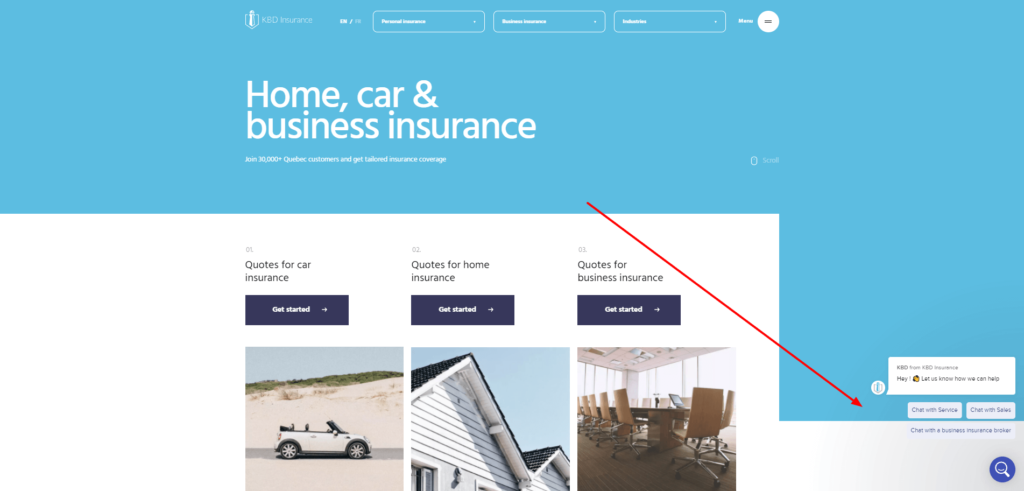

If you’re insured with KBD already, you can make this transaction via chat on our website as well.

Some insurance companies will allow you to add non-family members to your policy without hassle.

Others will require you to get a separate policy.

⚠️ Important: When adding a roommate to your policy, you have to notify the insurance company to raise the “content / personal belongings” policy limit.

Your old policy includes a certain valuation of your contents. .

But unless your roommate moved in off the street with nothing to their name, they have stuff too.

Add the value of their contents to yours to come up with a new number.

Yes, your premium will go up. But like we said, it’ll only be 15 or 20 bucks.

Wrap-up

If you live with a direct family member or spouse, that person is automatically included under your renters insurance policy.

If not?

You have to add them as an additional named insured.

Or you can have them get their own policy.

Adding a roommate to your existing policy has pros (cost savings) and cons (shared responsibility for claims).

Weigh your options and do what’s best for you.

Then call your insurance company and lock it in.

Simple as that.

All that’s left to do now is the lame cool-guy handshake.